Psychoeconomics: globalization, markets, crisis - Страница 8

A hardly perceptible, and at times simply imperceptible change of the agents of economic activity in terms of all the metaprograms, accentuations, and psychotypes that have been examined before goes unnoticed by its participants. But in the aggregate, according to the degree of growth of these cumulative causes, we see the result, namely a change in the trendline. And only after this change has occurred does consciousness look around for the causes of this phenomenon.

And before it can reach extreme values, some psychological indicator (value, accentuation, personality trait, metaprogram, etc.) passes through an oscillatory correction, and sometimes a real change, in a specific person or in a group of people. That is, the swings exist within the cycles designated on the graph. They are universal. Behind these swings stands an oscillating change of consciousness and even the culture of the subject of economic activity in the widest sense of this word. That’s how people are constructed.

Previously, these swings differed between countries. Today, thanks to the globalization of our world, these swings are becoming increasingly synchronized.

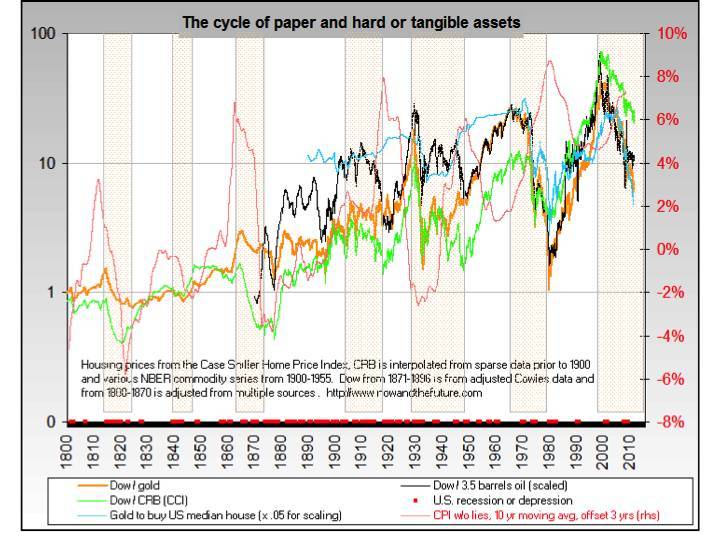

The presence of a high proportion of speculative capital has led to a situation where different market fragments may oscillate with different amplitudes; more importantly, some elements of the market begin to have amplitudes that oppose each other. This often affects the stock and commodities markets. This is understandable, as a speculator has no time to wait when the market is falling. He needs constantly growing markets. This is absolutely necessary when profit in the financial sphere is continually higher than profit in the manufacturing sphere, while everyone’s debts cannot be repaid through profits in production. In a period of growth of the hysteroid type, of emotional people, in the period of dominance of the post-postresonators all social and personal expenditures are bound to increasing financial profit. Otherwise social protests and psychological crises arise.

Therefore, the agents of economic and financial activity are forced to quit investing their resources in a market that is beginning to settle down, and they begin transferring their assets to a growing market. These decisions of capital speculators led to an antiphasic swing of the stock and commodities markets, and likewise to antiphasic growth of some financial “bubbles”.

How then do psychoeconomic cycles change? This can be seen by juxtaposing the graphs of the cyclicity of the appearance of various economic indicators and the cycles of solar activity. Foreign economic statistics present various statistical data and charts. One of them is special. It is known as the "One Chart to Rule Them All". It is presented in the graph below.

http://nowandfutures.com/key_stats.html

Dow – Dow-Jones Index

СRB (CCI) – Commodity Research Bureau (Continuous Commodity Index). An index of commodity prices. This indicator is based on statistical concepts.

CPI – Consumer Price Index, an index of consumer prices, also an index of inflation – a type of index of prices designed to gauge the average level of prices for certain goods and services (a consumer basket) for a certain period in the economy. The consumer price index determines the change in the level of various prices for a “fixed basket” of goods and services. Prices of imported goods and services are included in the calculation of the index. The consumer price index is the main indicator of a country’s level of inflation.

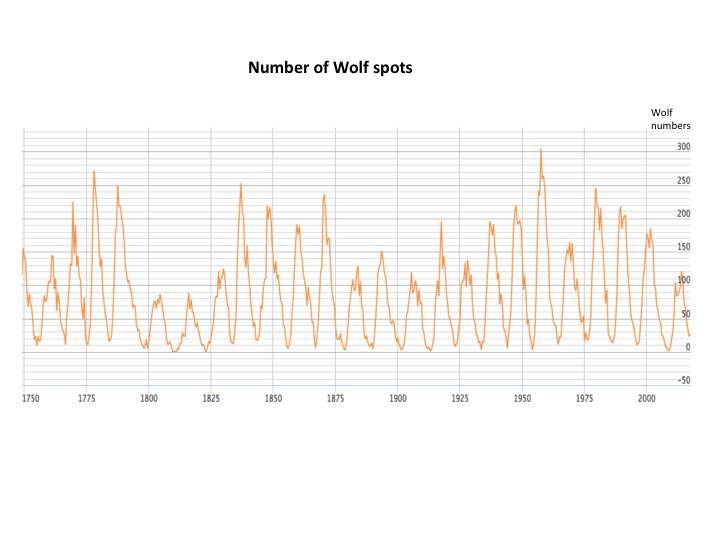

We first turn our attention to the change in the CPI. To interpret it, we need to refer to the conclusion we reached previously – hundreds of years ago, a few years of the sun heating up people’s psyches were required for hysteroid reactions to begin to actively appear in social processes. Currently the effect of the sun on people has become more indirect. This is due to a number of causes: the fact that the sun shone more intensively in the previous cycle, and that we became more emotional in this cycle of development, and that people more often began to work at professional types of activity that were more related to the development of the mechanism for opening and closing the circuits of nervous impulses. It was also related to other factors. We can similarly notice that the effect of the sun on people will also depend on the leading psychotype of the elite, of the population. In a period when resonators are dominant, the effect of the sun on their psyches will be smaller, since the mentality of such people is less emotionalized.

In a period when the values and culture of the hysteroids dominate, the influence of the sun will be more direct and stronger.

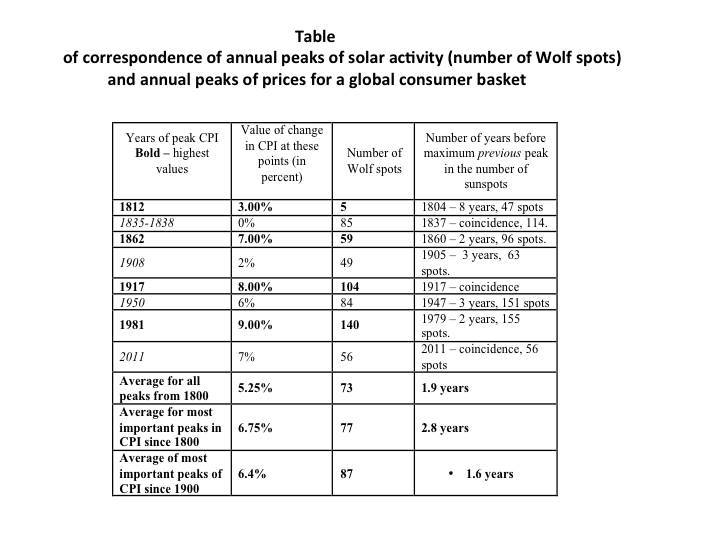

Peak prices of the consumer basket occurred in 1812, 1862, 1917, and 1979. This occurred worldwide. But we know that the development of the world economy in these years was by and large the development of the US economy.

So, there are peak values of the consumer basket, there are peaks of solar activity, and there are transient increases in the Wolf number of sunspots. We summarize these data in the table.

For a base we will take the well-known tables of solar activity (see L.V. Konstantinovskaya. http://www.astronom2000.info).

The rank correlation coefficient between the amount of change in CPI at maxima and the number of Wolf spots equals 0.56. The corresponding coefficient of determination is 0.31. This suggests that the increase in the price of the consumer basket at points of change in the trendline of its value before the beginning of a price decline of less than a third is statistically related to, or simply coincides with the activity of the sun.

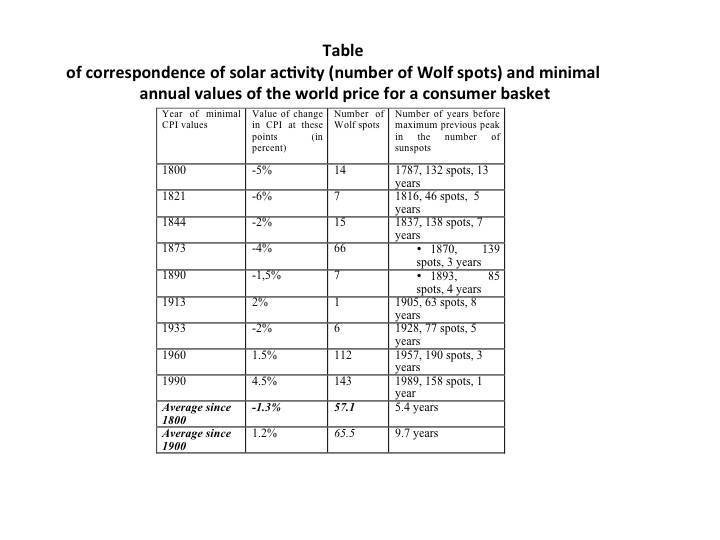

The range correlation coefficient between the amount of change in the CPI at minima and the number of Wolf sunspots is -0.43. That is, a flex point in the trendline of change in the CPI at the minimum occurred more often at the same time as the maximum solar activity. But this correlation is not as close as with maximum values of the CPI. The value of the determination coefficient confirms that solar activity is only 20% correlated to, or statistically coincides with the fall in the cost of the consumer basket at turning points.

However, in both the first and second cases, this is not a random relationship.

With a random correlation of these factors at minima of values of the CPI, the average number of sunspots was the mean over all these years. This number varies depending on the century and decade. In the nineteenth century, on average there were 42 Wolf spots per year, while in the twentieth century, there were 61. For two centuries on average this was a little more than 50 spots. But the average time that peaks of solar activity preceded the peak values of the CPI index over the two centuries was around 5.5 years.

Of course, here there is much that is misleading. All these calculations have been done technically, as though they were beyond qualitative analysis. Thus, in 1908, the peak CPI value was right behind that of 1907, when the number of sun spots was 62. But for 1905 we calculated a maximum of 63.5 sunspots. However this “deception” is not in support of evidence of a connection of solar activity with psychoeconomic processes on earth, but conversely. This is a purely statistical calculation. Nevertheless, it is clear that in some cases the connection between the sun’s magnetic radiation and people’s behavior on earth can begin, and actually does begin, before the onset of a peak of solar activity, and is influenced by the ascending trendline of prior years. But even with this calculation it is possible to confirm that the most important peaks of CPI values are related to peaks of solar activity. Minimal values have a weaker connection. Only in the twentieth century did the cycles of minimal CPI values start to approximate cycles of solar activity.